An endowment is a fund composed of charitable donations made to a university. Endowments are used to support a wide variety of institutional activities, but the vast majority of endowment funds support groundbreaking discoveries in scientific and medical research and student financial aid programs.

Correcting Fundamental Misunderstandings of College Endowments

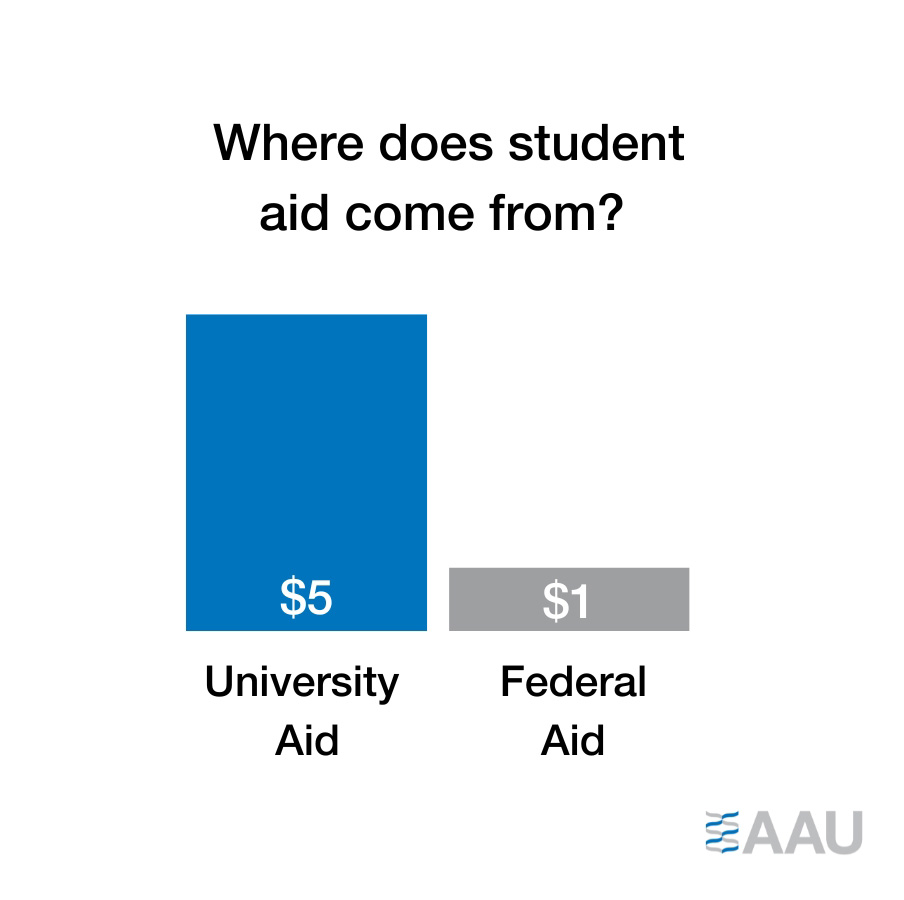

Thanks to these endowments, America's leading research universities are able to provide significant financial support for students; our students receive six times as much aid directly from our institutions as they receive from the federal government. America’s leading research universities are also at the forefront of medical and scientific innovation, much of it funded by donations. This wouldn't be possible without endowments.

America’s leading research universities are also at the forefront of medical and scientific innovation, much of it funded by donations. This wouldn't be possible without endowments.

In 2017, Congress imposed a new tax on university endowments which they expanded in 2025 -- taxing scholarships, medical and scientific research, and the jobs created by America’s leading research universities. If this scholarship tax is not reformed, the result will be less financial aid for students and delayed work on the development of cures for diseases like cancer, Alzheimer’s, or Parkinson’s.

Learn more about university endowments:

What are university endowments?

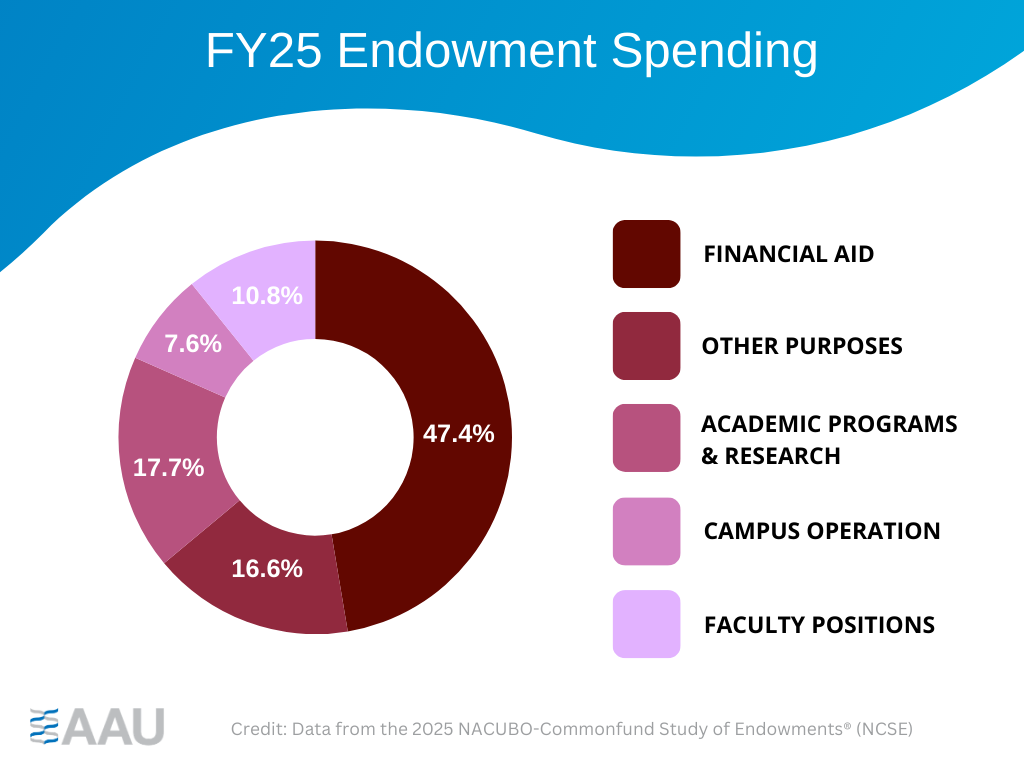

An endowment is an investment fund for a university that is really a collection of charitable donations – and many of those funds are restricted for specific purposes (like scholarships or cancer research). The returns from these investments are used to support student financial aid, provide long-term sustainable support for crucial scientific research, and subsidize many of the university’s other expenses – thus reducing the need for the school to get its operating revenue through other streams, like tuition hikes. In fact, in FY25 colleges and universities invested 65% of their endowment funds in student financial aid and academic programs. These increased investments by the institutions make college free or low-cost for thousands of low- and moderate-income students through endowment-supported scholarships and grants.

Endowments and research

America’s leading research universities are on the forefront of cutting-edge scientific and medical research – much of which is underwritten by endowment funds. Our scientists, doctors, and faculty lead the world in research on curing cancer, Alzheimer’s, Parkinson’s and countless other diseases that afflict millions across our nation. Taxing endowments robs valuable resources, much of it donated by those touched by these diseases, that would otherwise support this critical and life-saving research.

What is the endowment tax?

Congress in 2017 created an unprecedented tax on charitable endowments at leading American colleges and universities. It imposes a 1.4 percent tax on net investment income at private colleges and universities with at least 500 tuition-paying students and assets of $500,000 per student or more. The effect of the tax will accelerate in the coming years and will negatively affect many more schools so the funds will not be used for students and research, instead going to the U.S. Treasury.

Why is an endowment tax a bad idea?

Endowments are primarily funded by private charitable donations, not by taxpayer dollars. Their proceeds go to support good causes, with the vast majority used to make college more affordable and to support cutting-edge research. A tax on endowments is a tax on scholarships, medical and scientific research, and the jobs created by America’s leading research universities and colleges.

Aren’t schools with large endowments wealthy enough to afford the tax?

Endowments are charitable funds and shouldn’t be treated differently than any other not-for-profit foundation that supports a community-serving organization or a religious institution. The government doesn’t tax other nonprofits, like museums or religious institutions, simply because they have earned the generous support of donors or have prudently managed and grown their assets over decades.

Isn’t the point of the tax to address the issue of rising tuition and student debt?

The scholarship tax actually negatively impacts student tuition and debt. The universities impacted by the endowment tax are the leaders in expanding student financial aid and access, much of it underwritten by the proceeds from endowment funds. They all offer financial aid that meets the full need of their students, but must rely heavily on their endowment resources. For every dollar of federal student aid given to students at America’s leading research universities, the universities provide six. Taxing endowments reduces our ability to provide this aid.

Are there limits on how endowment funds are used?

Endowment funds aren’t simply savings accounts or “rainy day” funds. They are composed of charitable donations, and these donations frequently come with restrictions on their use -- such as a donor requesting the funds they've contributed support cancer research or a specific scholarship fund. By law, universities are not free to use these restricted funds for purposes other than what the donor stipulated.

Why are endowments important?

Endowments are a long-term resource, designed to support the financial needs of students and researchers over a lifetime -- or in most cases, over many lifetimes. They provide a way for universities to finance the valuable and necessary investments in scholarship and research Americans depend on every day, at no cost to the taxpayer.

Charitable gifts are a critical source of revenue to nonprofit colleges and universities. These gifts are sometimes used to fund current operations through annual giving campaigns, while other gifts are directed to the long-term needs of the university. The basic principle underlying the charitable income tax deduction for gifts is that taxpayers should not be taxed on income that does not benefit them directly—because they give that income away to support the public good.

Many gifts are given to a university’s endowment. Endowments are complex, usually consisting of many—sometimes thousands—of different funds. Typically, most endowment funds are restricted by donors to support specific purposes, such as student scholarships, cancer research, and professorships. Colleges and universities are legally required to uphold donor intent when managing and spending endowment income.

Research universities use their endowments to support their educational missions of teaching, research, and public service by teaching students, performing research, and addressing problems affecting communities, states, and the nation. Endowments are also a critical source of student financial aid that helps to make college accessible and affordable.