Congress should avoid misguided attempts to tax nonprofit funds that support scholarships and research.

Recently, the National Association of College and University Business Officers released its annual report on college and university endowments . It found that, in 2022, while most college endowments lost money due to the decline in the stock market, they spent more of their endowment proceeds than in the previous year. These expenditures supported scholarships, teaching, research, and other important educational work. Nonetheless, some in Congress and in state legislatures are looking to levy further taxes on these charitable funds, undermining college affordability while claiming to do the opposite.

The impetus behind these proposals – attempts to expand an unprecedented tax, created by Congress in 2017, on the most successful such endowments – is often based on a fundamental misunderstanding of what endowments actually are, how they work, and what they support. It’s time to set the record straight.

Many commentators in recent years have argued that colleges should spend more of their endowments to cut tuition. However, funds from the 2017 endowment tax go directly into the United States Treasury’s general fund and are not designated to support any particular educational or social program. But endowments are like charitable trusts, designed specifically to make a college education more affordable. Taking money from them to pay for any other cause – including taxes – actively undermines the purpose of making college more affordable.

Endowments are actually composed of thousands of individual funds created by charitable donations that universities have received over many years; the proceeds from most of these donations are legally restricted to use for particular purposes set out by the donor (such as specific scholarships or disease research). University fund managers invest these endowment funds in stocks, bonds, and other financial products that, over time, produce returns that then go to support the university’s nonprofit educational purposes. They are not unlike a foundation or charitable trust that supports the operations of a church or synagogue.

But some talking heads and policymakers seem to think that endowments are more like piggy banks or rainy-day funds whose principal colleges could just spend, if they wanted to, to cut tuition. But the endowments already exist specifically to subsidize tuition or support research and other educational programs.

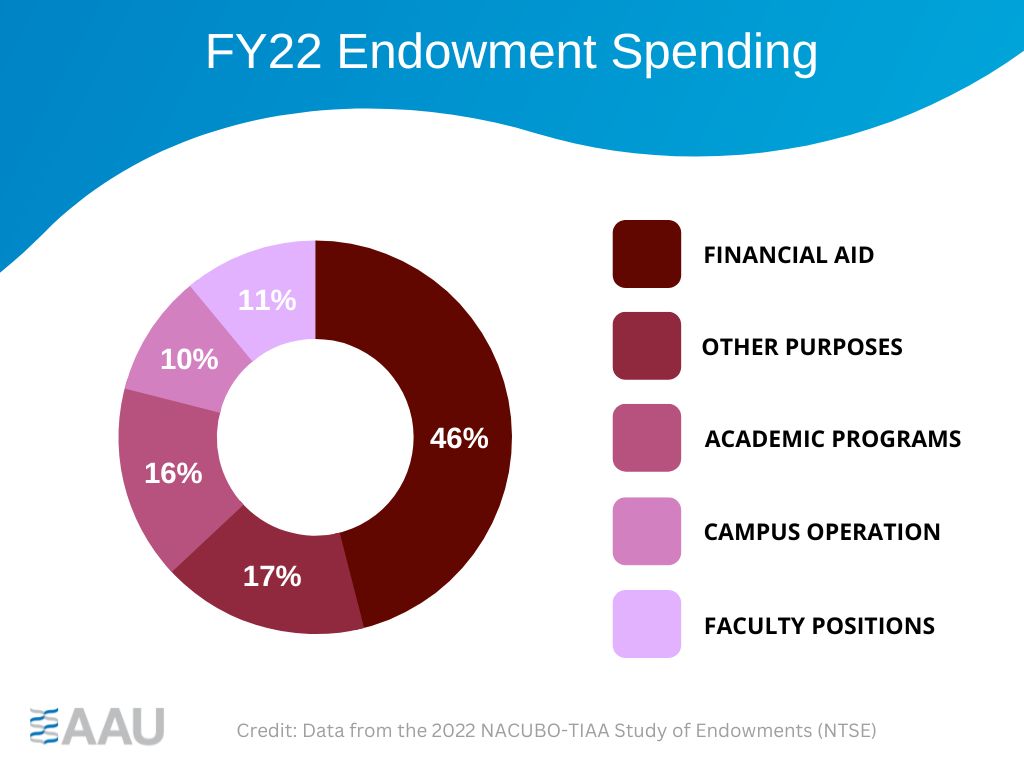

Indeed, of the $25.85 billion in 2022 university endowment expenditures the NACUBO study identified, more than 60% went to support scholarships , other student financial aid, and research and academic programs. Another 11% of endowment expenditures supported faculty salaries, and an additional 10% underwrote campus operations and maintenance – functions ranging from replacing a dormitory roof to enabling the provision of student mental-health services.

Taxation of these charitable funds, therefore, reduces the amount available to colleges and universities to support their educational missions just like taxing a church’s foundation proceeds would reduce the amount the congregation has available to run a soup kitchen or support its preschool program. Where do politicians who support raising endowment taxes think universities could make up the difference?

Even though the tax that Congress passed in 2017 currently only applies to a small number of university endowments, it still raises approximately $200 million per year. This is money that could be better spent by these institutions to provide more scholarships and grants or fund lifesaving cancer research. Instead, now it simply disappears into the United States Treasury without doing anything to support any specific educational or charitable purpose or to make college more affordable.

Is doubling down on this error really what policymakers want? As the work of the 118th Congress enters its full swing and as state legislatures gather, AAU is laboring behind the scenes to fend off any new proposals to expand on these misguided and counterproductive taxes.