By Kritika Agarwal

The House will soon consider a bill that would – via taxation – eat away at a crucial source of funding that colleges and universities use to support student scholarships and groundbreaking research.

On Wednesday, May 14, the House Ways and Means Committee advanced its portion of President Trump’s “One, Big Beautiful Bill” dramatically increasing taxes on income generated from college endowments.

Endowments are funds composed of charitable donations made to institutions of higher education. Universities invest the donations into stocks, bonds, or other financial products and then use the returns on those investments to support student aid and a wide range of academic and research activities.

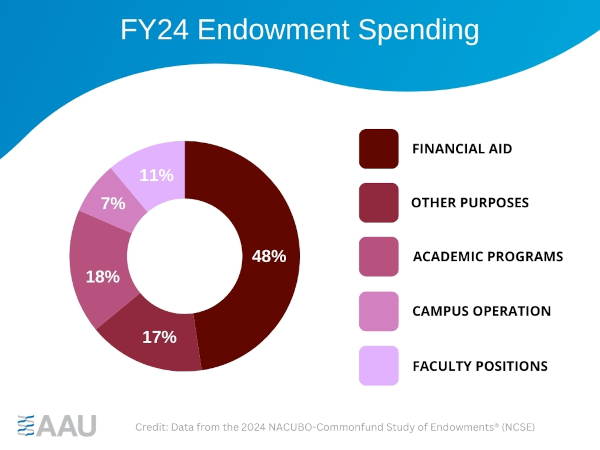

A recent report by the National Association of College and University Business Officers (NACUBO) found that universities spend nearly half of all earnings from endowments to provide scholarships and other forms of financial assistance to students. The other half goes to funding academic programs and research, faculty positions, and the operation and maintenance of campus facilities.

Princeton University, for example, uses its endowment to provide financial aid to 71% of its undergraduate students. In 2022, the university used endowment funds to provide its graduate students with a 25% stipend increase.

At the Massachusetts Institute of Technology, earnings from the endowment and other investments provide more than 40% of the university’s annual budget. “MIT’s endowment allows us to offer free tuition for families earning less than $200,000, and attendance at no cost to families earning less than $100,000,” the university notes.

The primary beneficiaries of college endowments are, thus, not the institutions themselves, but students, faculty, and the American public that benefits from university research and the presence of universities in their communities.

While current law imposes a 1.4% tax on private colleges with large endowments, the new bill would raise that tax rate for some schools to anywhere from 7% to as high as 21% depending on the ratio of endowment size to the number of students. Because the bill excludes international students from the count of enrolled students used for the purpose of determining the final tax rate, universities that currently do not owe any endowment taxes could soon be required to pay them.

It is important to note that the federal government does not use taxes collected on endowments to support higher education, student aid, or research; instead, endowment tax revenues go into the U.S. Treasury’s general fund and are used to finance other government activities or to reduce the national deficit.

The Boston Globe conservatively estimates that universities such as “Harvard, Yale, Stanford, Princeton, and MIT would each owe more than $410 million in taxes a year” (the actual tax payments could be significantly higher given that the proposal also adds two new forms of university income to the overall calculation). Thus, proceeds from the endowments that would previously have gone to support students and researchers would instead be diverted to fund other government priorities, including tax cuts for corporations and wealthy individuals.

In the name of holding elite institutions accountable, Congress is proposing a scholarship tax that would make college less accessible and affordable. As AAU President Barbara R. Snyder asked in a 2023 blog item on endowment taxes, “Where do politicians who support raising endowment taxes think universities could make up the difference?”

Kritika Agarwal is senior editorial officer at AAU.