The following Q&A answers common questions about facilities and administrative costs (or F&A costs, for short) which are real costs universities pay to conduct research on behalf of the American public.

1. What are “facilities and administrative” (F&A) costs?

F&A costs – also referred to as “indirect costs” – are essential costs of conducting research. The federal government’s longstanding recognition and payment of its share of these costs has helped U.S. colleges and universities build and support the required research infrastructure that has made the American research enterprise the best in the world.

When the government provides a grant to a university for a research project, a portion (typically 67-75 percent) of the budget is available directly to the research team. This “direct costs” portion supports researcher salaries, graduate students, equipment, and supplies. Another portion (typically 25-33 percent) covers necessary research infrastructure and operating expenses that the university provides to support the research. These research expenses – officially “indirect costs” but more descriptively called facilities and administrative (F&A) costs – include: state-of-the art research laboratories; high-speed data processing; national security protections (e.g., export controls); patient safety (e.g., human subjects protections); radiation safety and hazardous waste disposal; personnel required to support essential administrative and regulatory compliance work, maintenance staff, and other activities necessary for supporting research.

2. Why does the federal government provide support for F&A costs of research?

F&A costs are research costs. Universities and the federal government have a long-standing and successful partnership that grew out of World War II. The federal government relies on universities to conduct research in the national interest. This includes research aimed at meeting specific national goals such as health and welfare, economic growth, and national defense. Performing research on behalf of federal agencies incurs a variety of expenses that would not otherwise exist for universities. Universities – not the federal government – assume the risk of building the necessary infrastructure to support this research in anticipation that their research faculty will successfully compete for federal research grants and thus the university will be reimbursed for a part of the associated infrastructure costs.

3. Do universities contribute any of their own funds towards research?

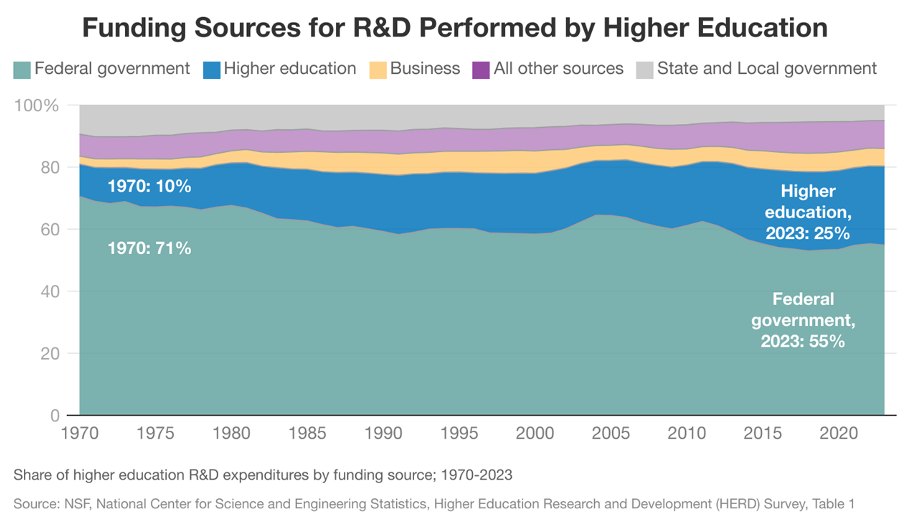

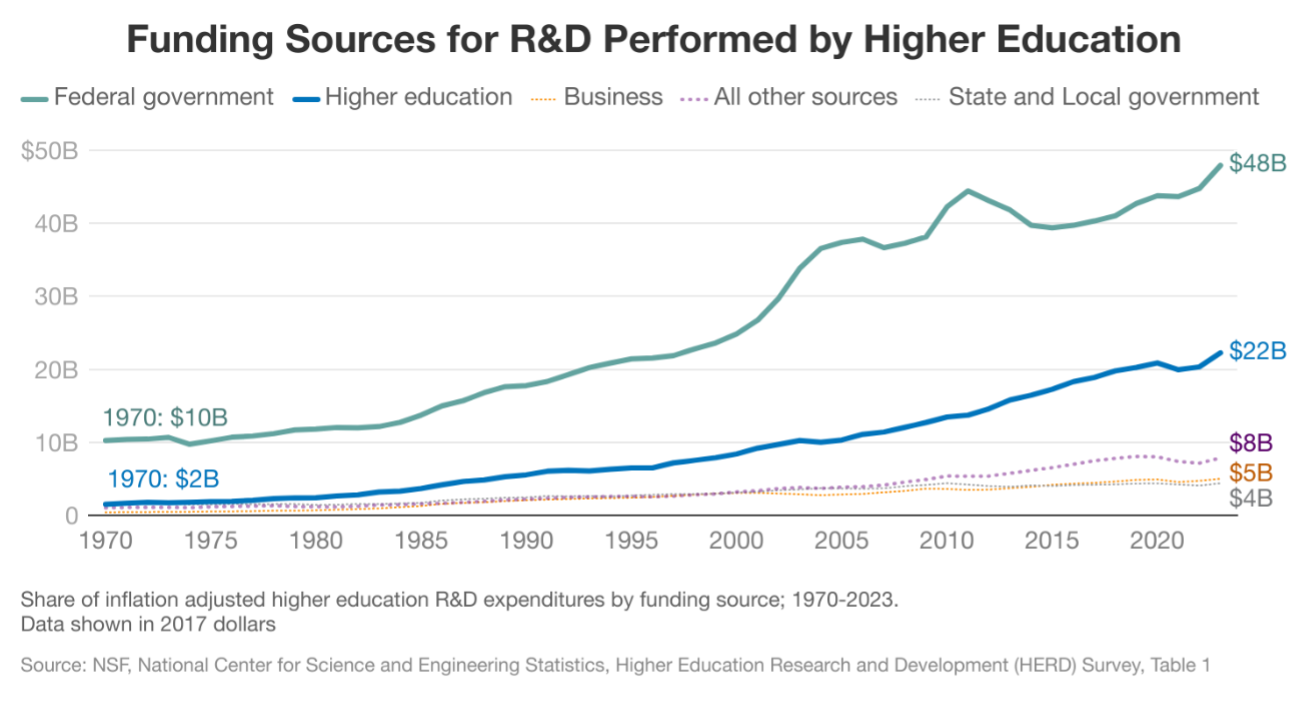

Yes. Behind the federal government, universities are the second leading sponsor of the academic research and development (R&D) that take place on their campuses. Federal data show that colleges and universities pay for 25 percent of total academic R&D expenditures from their own funds. This university contribution amounted to $27.7 billion in FY23, including $6.8 billion in unreimbursed F&A costs. These institutional commitments to academic R&D significantly exceed the combined total of all other non-federal sources of support for academic R&D: state and local government (5 percent), industry [businesses] (6 percent), and foundation [other non-profit organizations] (6 percent) support in FY23. Federal spending on higher education R&D was almost $60 billion in FY23, or 55 percent of all funding for academic R&D (See figures 1-2). While universities contribute significantly to the costs of research, their available resources continue to be stretched thin. State support for public universities has declined greatly over the past 20 years and, in many cases, universities are educating more students. The notion that universities should cover even more of the expense of conducting research for the federal government is not realistic.

Figure 1

Figure 2

4. Do universities ‘profit’ from the F&A cost reimbursements they receive associated with federal research grants?

No, universities absolutely do not financially gain from their F&A recoveries. As defined by the federal government, these are reimbursements for costs incurred by universities in conducting research on behalf of the government, and hence, it is impossible for the costs reimbursements to result in a profit. In fact, universities are not even fully reimbursed for the expenses they incur to provide the necessary infrastructure and support to conduct federal research. According to data collected by the NSF, in FY23 universities contributed approximately $6.8 billion in facilities and administrative expenditures not reimbursed by the government, many of which were not covered because of an Office of Management and Budget (OMB) cap limiting the amount the government can repay universities for administrative and compliance related expenses, including federal mandates.

5. Has the university contribution to research been increasing or decreasing?

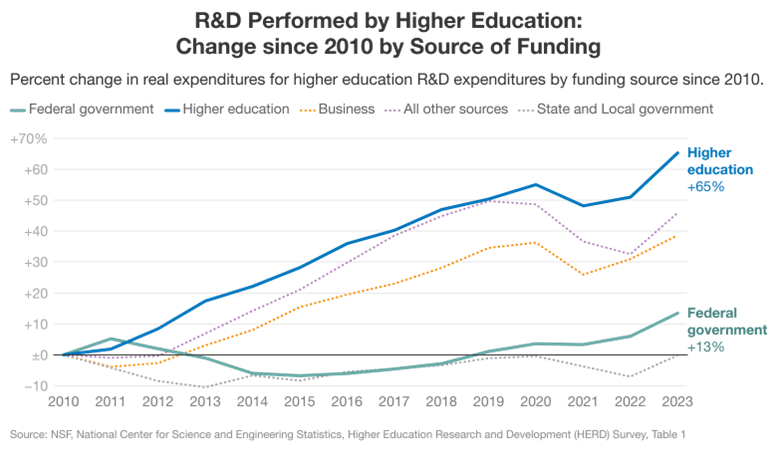

Increasing. Over the past several years, the amount of institutional support in real dollars that colleges and universities provide for research conducted by their faculty has grown 65 percent since 2010, faster than any other sector, including the federal government which has seen only 13 percent growth since 2010 (See figure 3). The increase in institutions’ support for the R&D they conduct is due in part to the rising compliance costs associated with increased federal research regulations in areas such as human subject protection, export control compliance, and ensuring research security and integrity. Despite the increasing administrative expense for compliance, the amount universities can be reimbursed from the government for these costs has been capped by OMB since 1991, at a rate that has never increased. This cap only applies to higher education institutions. Unlike other sectors that conduct government research, universities must, therefore, subsidize compliance costs from their own financial resources.

Figure 3

6. Has the percentage of federal funding for F&A cost reimbursements changed over time?

No. F&A costs recovered by research institutions have remained flat for over 20 years. For example, the National Institutes of Health’s percent of total funding going towards F&A cost reimbursements has remained unchanged, at approximately 27-28 percent of total funding, for more than two decades (see figure 4).

Figure 4

NIH Direct and F&A Awarded (Dollars in Thousand and Percent)

Fiscal Year | Direct Cost Awarded | F&A Awarded | Total Awarded | Direct as a Percent of Total | F&A as a Percent of Total |

| FY 2002 | 12,822,068 | 4,835,456 | 17,657,524 | 72.6 | 27.4 |

| FY 2007 | 15,387,745 | 5,876,060 | 21,263,805 | 72.4 | 27.6 |

| FY 2012 | 15,978,032 | 6,182,900 | 22,160,932 | 72.1 | 27.9 |

| FY 2017 | 17,799,515 | 6,838,801 | 24,638,316 | 72.2 | 27.8 |

| FY 2022 | 23,352,941 | 8,993,865 | 32,346,806 | 72.2 | 27.8 |

Source: Congressional Justification of the NIH FY2025 budget request; Overview of 2025 President’s Budget

7. How much does the federal government pay for university F&A expenses compared to what it pays other government research performers such as the national laboratories and industrial contractors?

Past studies suggest that proportionately, F&A expenses for university research are slightly less than those for other research performers. A study in 2000 by the RAND Corporation found universities had the lowest percentage total research costs classified as F&A (31 percent). Federal laboratories were somewhat higher at 33 percent and industrial laboratories were higher still at 36 percent. This demonstrates that universities are efficient performers of research. Unfortunately, a study comparable to the RAND study has not been undertaken in recent years. Such a study would be welcomed by the university community.

Additionally, as indicated under the previous question, the federal government’s payment to universities for its share of F&A costs does not reimburse the universities’ full expense. This is unlike other sectors that receive full compensation for all their expenses. The federal government has smartly invested in university-based research: F&A costs at universities are lower than other sectors, the government does not pay a profit to universities like it must for industry research performers, there is a university-specific cap on the amount the government will cover for administrative expenses, and the system of agency oversight ensures universities continue to be excellent stewards of federal taxpayers’ dollars.

8. Can universities itemize F&A expenses for each research project grant?

No. F&A expenses cannot be itemized for each research project because they, by definition, are costs incurred for common or joint purposes, benefit more than one activity, and are not easy to allocate directly to their benefiting activities. F&A costs are, therefore, aggregated with each institution totaling its costs incurred for hundreds (and at large research institutions, thousands) of individual awards that faculty and institutions annually receive. Total F&A costs are then divided by a subset of direct research costs to arrive at an F&A cost rate, which is then reviewed and approved by the government and applied to the same subset of direct research costs, on a project by project basis. This reimbursement methodology is widely accepted by the federal oversight and audit community, and it provides a much more efficient and rational approach to reimbursing universities for these costs than attempting to allocate them to individual projects or negotiating and determining an F&A rate for each individual research award. The sheer volume of grants, contracts, and other awards received by universities from various federal agencies, many of which are small in size, means having an established F&A rate makes the grant process more efficient.

9. Since foundations pay less for F&A costs reimbursements than the federal government, is the federal government subsidizing the infrastructure required to do foundation-sponsored research?

No. To the extent that a foundation does not pay for certain F&A expenses, these costs must be covered by the institution. OMB rules (2 CFR Part 200 - Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards) specifically require universities to ensure the federal government does not subsidize non-federally sponsored research activity – including research and associated infrastructure costs performed by universities for private foundations.

However, foundations categorize and pay grant-related expenses very differently than the federal government. For example, foundations often categorize some items as direct expenses that federal rules require to be classified as F&A expenses and do not have strict rules regarding consistent classification of costs. This further underscores that direct and F&A costs are all part of total research costs.

Additionally, as previously noted, after World War II the federal government consciously chose to encourage universities to conduct research on its behalf to help achieve national goals. A core tenant of the partnership between the federal government and universities is that the government shares in the costs of research by providing universities with competitively awarded grants to support the people, tools, and infrastructure necessary to conduct high-quality research for the nation. Historically, most foundations view their grants as supplementing research that scientists are already conducting. To this day, most foundation research funding is viewed as supplementing existing federal and non-federal research.

Finally, foundation funding for university-based research remains a small proportion of total academic R&D funding (only 9 percent) compared to federal funding (52 percent) and the funding provided to support academic R&D by the colleges and universities themselves (28 percent). Therefore, to the extent institutions are not reimbursed by foundations for F&A costs, it is less difficult to cover the different from other, non-federal, sources.s for F&A costs, it is less difficult to cover the different from other, non-federal, sources.

10. Are federal F&A cost reimbursements used to subsidize other campus accounts, such as athletics or student housing construction?

No. OMB rules (2 CFR Part 200 - Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards) require that F&A cost reimbursement rates only be based on research facilities, operations, and support used by federally funded research, not education or other university facilities or activities.

11. Is it true that universities with F&A rates over 50 percent spend more than half the grant funds they receive from the federal government to pay for F&A expenses?

No. A university’s F&A cost rate is not a percent of the total grant, but rather a percentage only a subset of the research project’s direct costs. Currently, the average amount paid to universities for F&A expenses is approximately 25-33 percent of the total amount of a grant. (Campuses with medical centers tend to be closer to 33 percent because of the higher costs involved in providing for medical research facilities.)

12. How does the F&A rate determine how much a university receives for F&A costs on a grant?

To determine the level of F&A expenses the federal government will cover, every 2 to 4 years, the agency responsible for setting a university’s F&A cost rate (either the Department of Defense Office of Naval Research or the Department of Health and Human Services) will comprehensively audit and/or assess these shared costs to determine the appropriate federal reimbursement rate based upon specific costs that have been deemed allowable expenses by the OMB. The reimbursement rate is a percentage of a subset of direct research costs (not a percentage of total award). Some direct research costs (like equipment, capital expenditures, charges for patient care, rental costs, tuition remission, and scholarships and fellowships) are excluded from the direct cost for F&A cost calculation purposes. This remaining amount is known as modified total direct cost (MTDC)

For example, after reviewing the costs of a university’s research projects during a base year, and considering anticipated changes such as increases in MTDC, a university and the federal government may determine that an amount equal to 50 percent of research MTDC is appropriate for the federal government to contribute toward F&A expenses. In that case, if the federal government awards a university $445,000 for the direct research portion of a grant, of which $365,000 is the modified total direct cost1, then it also awards $182,500 for F&A cost reimbursements, for a total of $627,500. These overall institutional F&A cost rates are applied uniformly to each research grant as its direct funds are spent, avoiding the very tedious, expensive and inefficient process of computing the F&A expenses for individual awards – which would add additional costs for both the government and the university.

| Research Budget | NIH R01 (Lab-based) |

| Direct Costs | |

| Personnel | |

| Principal Investigator (MTDC) | 60,000 |

| Lab Techs / Scientists (MTDC) | 130,000 |

| PostDocs / Grad Students (MTDC) | 115,000 |

| Supplies (MTDC) | 55,000 |

| Travel (MTDC) | 5,000 |

| Grad Student Tuition | 20,000 |

| Equipment | 60,000 |

| SUB-TOTAL | 445,000 |

| MODIFIED TOTAL DIRECT COSTS (MTDC) | 365,000 1 |

| Indirect Costs | |

| NIH R01 F&A (50% applicable to MTDC) | 182,5001 |

| F&A AS % OF TOTAL BUDGET | 29.08% |

| TOTAL RESEARCH BUDGET | 627,500 |

1 An institution’s F&A rate is applied to modified total direct costs (MTDC). In this example, personnel ($305,000), supplies ($55,000), and travel ($5,000). Therefore, the 50% F&A rate is applicable to the sum of these cost items ($365,000), resulting in an F&A amount of $182,500.

13. Why do F&A cost reimbursement rates vary between institutions?

Federal agency officials and university administrators predetermine an overall percentage of allowed F&A cost reimbursements to be paid, based on documented historical costs and cost analysis studies. The final rates allowed for F&A expenses are established based on a rigorous review and audit of the actual funds previously spent for such costs. F&A cost reimbursement rates vary from institution to institution because construction, maintenance, utilities, and administration costs vary by institution and by region.

Additionally, F&A rates depend upon other factors such as the age and condition of facilities and buildings and the amount of renovation and construction needed to house certain types of research projects. For example, the F&A costs for a biomedical research facility built in an urban area that experiences earthquakes is different than an engineering research facility built in a rural area.

14. How would universities cover F&A costs if the government cut back on the amount it would reimburse?

Universities have a limited number of funding sources. The primary funding sources for research universities to fulfill their educational missions of teaching, research, and service are: tuition, research grants, cooperative agreements and contracts, philanthropy, endowment income, and state appropriations.

A reduction of federal F&A cost reimbursements would result in one or more of the following:

- The inability of universities to accept research awards from, and conduct research on behalf of, federal agencies;

- The deterioration of research facilities as the financial risk to build new facilities or maintain existing ones becomes too great to cover with institutional funds;

- The inability to sustain required support staff and infrastructure required to comply with government regulations; this could threaten the health and safety of patients, researchers and students;

- A reduction in the pipeline of trained scientists and engineers in the workforce due to reduced research training opportunities at universities.

- An increase in tuition rates.

Bottom Line: Cuts to F&A research costs are cuts to research. If such cuts are made, they will reduce the amount of research universities and their scientists can conduct on behalf of the federal government to achieve key national goals to improve the health and welfare of the American people, grow the economy, and enhance our national security.