By Kritika Agarwal

Colleges spent a substantial portion of their endowment funds on scholarships and groundbreaking research in FY25 despite declining returns on the funds and fewer donations, according to the latest NACUBO-Commonfund Study of Endowments.

Endowments are funds composed of charitable donations made to institutions of higher education. Investment managers working on behalf of universities invest the donations in stocks, bonds, and other financial products and use the proceeds to provide financial aid to students and support a wide variety of institutional activities, including scientific and medical research.

A total of 657 colleges, universities, and education-related foundations participated in this year’s NACUBO-Commonfund endowments survey. The study found that universities withdrew more from their endowments during what was a challenging time for higher education. In FY25 (July 1, 2024 – June 30, 2025), universities spent $33.4 billion out of their endowments, an 11% increase from FY24.

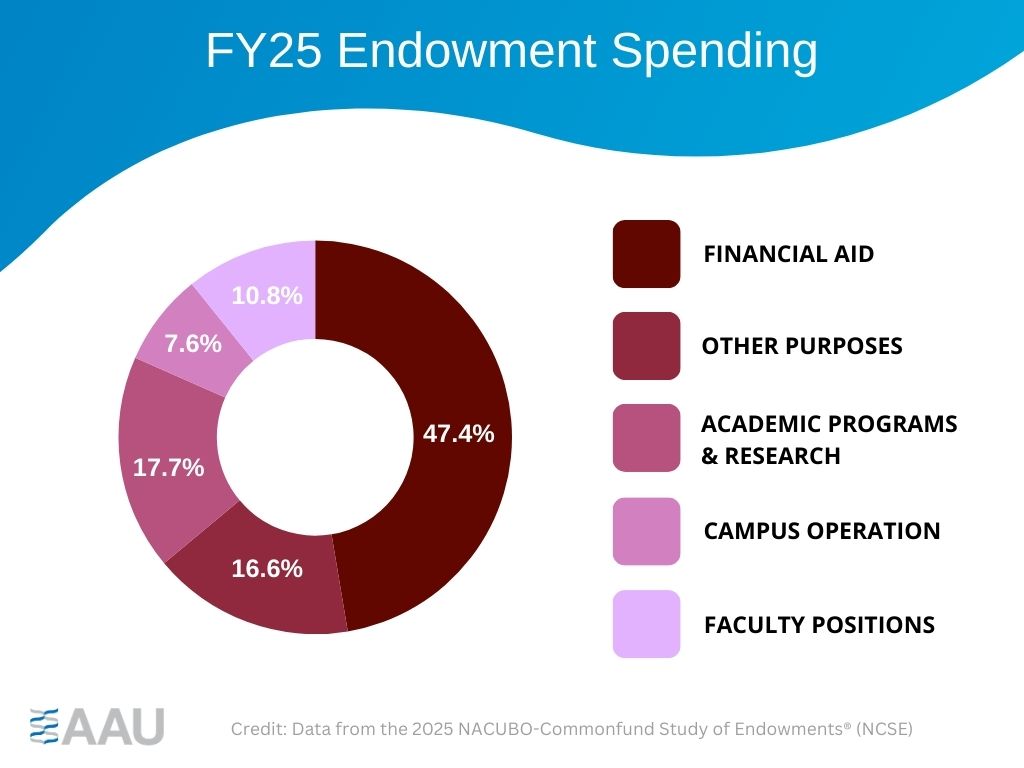

Nearly half of all spending (47.4%) went toward funding student financial aid programs. According to NACUBO, 17.7% of all spending went to academic programs and research; 10.8% to endowed faculty positions; and 7.6% to campus facilities’ operation and maintenance.

Several AAU members currently use endowment funds to provide tuition scholarships and grants to students from low- and middle-income families. Rice University, for example, uses endowment funds to support the Rice Investment, which provides full tuition, fees, and living expenses to students from families making $75,000 or less a year; full tuition to students from families with an annual income of $75,000-$140,000; and half tuition to students from families with an annual income of $140,000-$200,000.

Similarly, undergraduate students from families with incomes up to $200,000 pay zero dollars in tuition at Emory University because of its endowment-backed Emory Advantage Plus program. At the University of Texas at Austin, students from families in Texas making less than $100,000 receive free tuition and fee waivers as part of the University of Texas System’s Promise Plus Program, which is made possible by the Promise Plus endowment.

In fact, for every dollar the federal government provides in grants to incoming full-time students, AAU members provide nearly $7, largely due to endowments. “Endowments make college possible and more affordable, and contribute to better lives for all,” said NACUBO President and CEO Kara D. Freeman.

Despite these contributions, university endowments continue to face pressure from a number of directions, including from markets, donors, and taxes. NACUBO found that, in FY25, endowments at colleges and universities represented in the study reported a 30-basis point reduction in returns compared to the previous year, dropping from an average of 11.2% to 10.9%.

Further, in a concerning development, the study found that new charitable donations to the colleges and universities participating in the survey declined 9.2% overall, with some institutions seeing declines of as much as 26.5%. “Declines in gift-giving are a concern for all institutions, but particularly for smaller ones that may be less resourced and vulnerable to changes in fund flows,” NACUBO noted in a press release.

Taxes impose yet another challenge: In 2017, Congress created an unprecedented 1.4% tax on endowment income at certain private colleges and universities. Last year, Congress expanded that tax – the H.R. 1 reconciliation bill passed in July raised taxes on endowment income to as much as 8% depending on the number of students paying tuition at the university and the size of the endowment.

The NACUBO-Commonfund Study shows why a tax on university endowments is really a scholarship tax – higher endowment taxes will, inevitably, result in less institutional aid for students and fewer funds for research and faculty positions. This is especially true since the millions of dollars generated annually from the endowment tax go to the U.S. Treasury’s general fund and are not designated to support education programs.

Universities are already tightening their belts because of taxes on endowments and the uncertain federal research funding landscape – Princeton University President and former AAU Board Chair Christopher Eisgruber wrote to his campus community earlier this month that university leadership has asked “units across the University to make 5-7 percent cuts to their budgets” in order to “maximize support for key priorities amidst uncertainty about federal funding, endowment taxes, and other federal policies.”

The NACUBO-Commonfund Study confirms that endowments are vital assets that support students and the teaching, discovery, and innovation that keep America ahead of global competitors and sustain opportunity and progress throughout the nation. If endowments continue to face pressure and federal research support remains uncertain, universities will have far fewer resources to draw from in the future to make education more accessible and affordable and to conduct world class research.

Kritika Agarwal is assistant vice president for communications at AAU.